We at Accounting Assignments Help provide ACCT 311 Homework Assignment Help with step by step calculation and explanation 24*7 from our accounting experts.

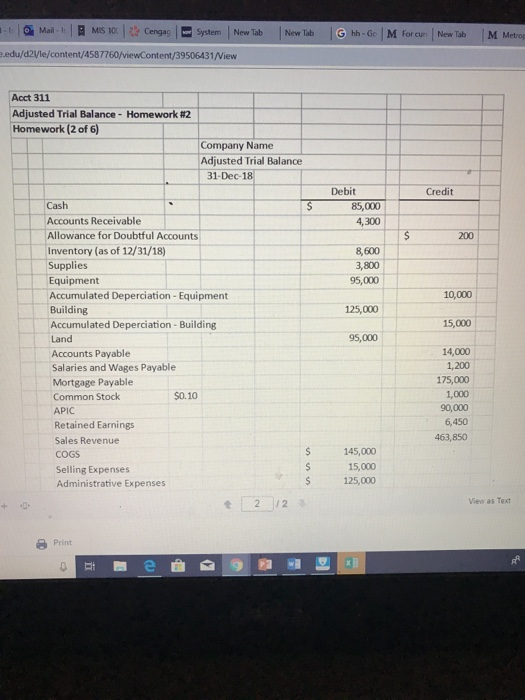

Using the information on the 12/31/18 adjusted trial balance (page 2) complete the following two parts. Note: An accompanying EXCEL file is provided see “Trial Balance for Homework 2”

Note: The owner cannot afford an accountant so she hires an accountant (you) to come in once a month during the year to make the necessary accounting.

Part 1 – For the 2018 Year-End

- Prepare closing entries

- Prepare post-closing trial balance

- Prepare the balance sheet as of 12/31/18

Part 2 – For 2019

Prepare journal entries for the following events…and then prepare the trial balance as of 1/31/19 AND prepare the Income Statement, Statement of Retained Earnings, and Balance Sheet for the month of January (1/31/19).

For the month of January, 2019 the following events/information need to be accounted for…

Event 1 – Jan. 31 -> Cash sales for the month of January were $85,000

Event 2 – Jan. 31 -> Administrative expenses for the month of January were $14,400 (total amount was paid in cash)

Event 3 – Jan. 31 -> Cost of Goods Sold (COGS) for the month of January were $18,000 ($12,000 was paid in cash AND the remaining $6,000 was on account).

Event 4 – Jan. 31 -> Income Tax Expense (total amount accrued) for the month of January is $6,000

Event 5 – Jan. 31 -> Depreciation expense (for the month) – equipment is $900

Event 6 – Jan. 31 -> Depreciation expense (for the month) – building is $1,200

Event 7 – Jan. 31 -> Accounts receivable of $3,300 was collected.

Event 8 – Jan. 31 -> Salaries and Wages payable is $0 at the end of the month.

Event 9 – Jan. 31 -> Month-end physical count of inventory and supplies shows that the month end balances are as follows:

Inventory -> $3,000

Supplies -> $1,200

Need help with ACCT 311 Homework Assignment please:

Email Us: support@accountingassignmentshelp.com

Chat with us